In the fast-paced world of business, the ability to manage cash flow effectively can be the difference between success and failure. In fact, as many as 82% of businesses that fail do so due to poor cash flow management. As a business owner, this statistic can be concerning. However, within this post, we will explore a tool that can help you navigate the turbulent waters of cash flow management and lead your business towards a brighter financial future – the Power of One.

The Power of One is a game-changing profit improvement tool developed by Verne Harnish and the team at Gazelles, as explained in Harnish’s book, ‘Scaling Up.’ It offers a strategic framework that focuses on seven crucial financial levers that can enhance your cash flow and returns, giving your business the boost it needs to thrive.

The seven financial levers in the Power of One are:

- Price: You have the power to increase the price of your goods or services strategically.

- Volume: By selling more units at the same price, you can boost revenue.

- Cost of Goods Sold/Direct Costs: Reducing the cost of raw materials and direct labor can enhance your profit margins.

- Operating Expenses: Trimming operating costs can free up valuable resources.

- Accounts Receivable: Collecting payments from debtors faster can improve cash flow.

- Inventory/Work in Progress: Streamlining your inventory management can lead to higher turnover and cost savings.

- Accounts Payable: Slowing down creditor payments can help you save on interest and reduce the need for additional borrowings.

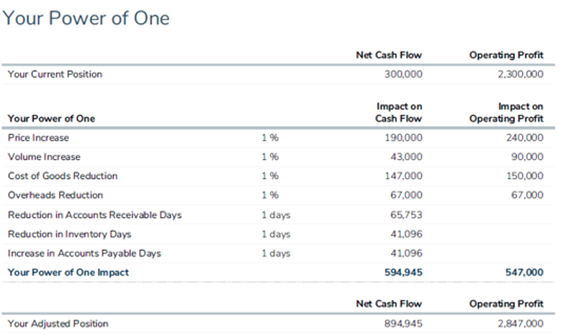

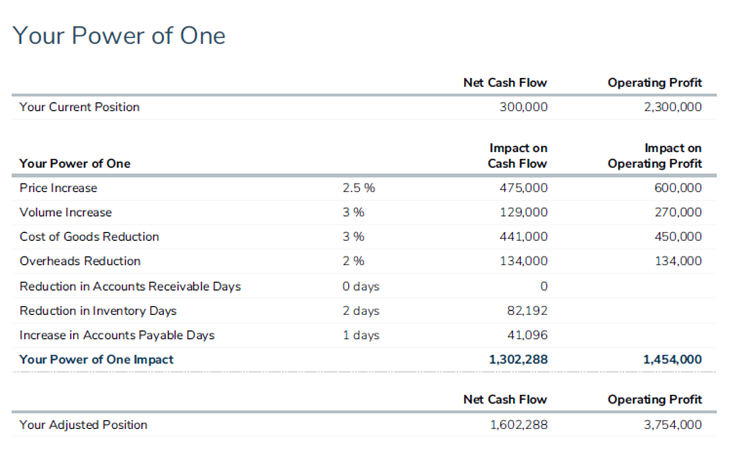

One of the most compelling aspects of the Power of One it its simplicity. It’s not about making massive, disruptive changes to your business operations. Instead, it’s about making small, incremental adjustments in these seven areas. Even a 1% improvement in each lever can create a significant positive impact on your bottom line as seen in the example below.

The Power of One concept prompts business owners and their management teams to acknowledge the cumulative impact of these slight enhancements. By dedicating attention to these levers, you can emphasize actions that will gradually pave the way to improved cash flow and heighted profitability over time. The organization can simply determine what levers to pull and by how much, to achieve the maximal amount of financial gain over the following 12 months.

But remember, profit doesn’t always equal cash. Just because your business is profitable doesn’t mean your cash flow is in good shape. If your expenses are higher than they should be, or if you’re reinvesting most of your profit back into the business, your cash flow may be at risk. Understanding where your business is spending or reinvesting its cash is crucial to making the necessary adjustments for a successful financial future.

So, do you know your current cash flow position and the opportunities for significant growth that await? If not, it’s time to harness the Power of One. As a Scaling Up coach, I can work with you to identify problem areas in your cash flow management and help you determine which financial levers to pull to put the most value back into your business. Get in touch today to get started on your journey towards better cash flow and profitability.